What is an annuity?

To understand how they work first you need to understand what an annuity is. In simplest terms, an annuity is designed as a long-term investment that grows tax-free (or tax-deferred) and can help you not outlive your income. It’s a contract between yourself and the insurance company that you choose for your annuity.

You can either make a single lump-sum payment to the company or a series of payments over some time. If you have questions about this, we are here to help.

Now that we’ve got the basics out of the way, there are three main types of annuities to choose from: fixed annuities, indexed annuity, and variable annuities.

Fixed Annuity: Fixed annuities by design help you reach your goals and they provide a guaranteed return for a set period of time. When deciding on a fixed annuity, you invest a certain amount up front to the insurance company. The insurance company would then guarantee a rate of interest over a specific period of time. Most fixed annuities are between 3 and 6 years. We would not advise you to buy a fixed annuity past 6 years.

Indexed Annuity: Fixed-indexed annuities are kind of a mix between a standard fixed annuity and a variable annuity. They offer a minimum guarantee of the interest rate plus a return that is linked to the market index (provided that the market is doing well). The good news is you can not lose any money, your account value can not go down. For example, if/when the stock market drops 30% this year, you will lose ZERO.

Variable Annuity: A variable annuity is a deferred annuity that allows you to participate in investment funds, such as bond mutual funds or stocks. It can be very volatile and usually comes with some pretty hefty service fees.

Today, I’d like to take a look at the difference between variable annuities and indexed annuities. Let’s start with the fees associated with each.

Variable Annuity: Annuity account fee, mortality fee, investment fees, surrender fees, early withdrawal fees, and possible additional rider fees (read your contract!) These fees can cost you anywhere from 3 to 4% per year.

“The truth is there usually is a big price to pay when it comes to variable annuities. The biggest drawbacks include the fees and the potential to lose value based on the performance of the subaccounts invested in the stock market.”-Alin Lozada with Forbes on variable annuities.

Fixed Indexed Annuity: Fixed index fees are much lower, while they could be up to 1.25% of the account’s annual value they are optional depending on if you would like to add a rider onto your annuity such as an income rider.

A variable annuity can be extremely volatile. While there is a possibility of higher returns and greater income than fixed Indexed annuities, there is also substantial room for loss. A variable annuity is basically like investing in the stock market, with additional fees associated with it. The only real difference is that the taxes would be deferred in the annuity.

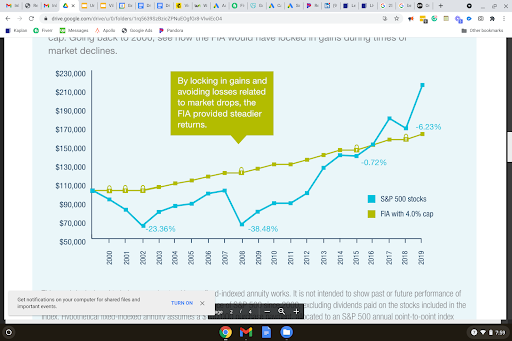

With an Indexed Annuity, although your balance is related to the stock market, your money isn’t at such a risk. When you first purchase an indexed annuity, the value of the chosen index is taken into account. Upon your contract anniversary date, if the index value is higher than when you first opened the account your annuity will be credited a percentage increase. If the index loses value and goes down, your original interest percentage will remain the same (no loss to you).

Here is a look at an index annuity and how you lock in your gains and avoid the downfalls of the market.

For a comparison of Fixed Annuities vs. Index Annuities please see the blog post.

Have additional questions? We are here to help you! You don’t need to be a current client of ours to get assistance. Please call us at (731)207-8548 or send us an email for further assistance.