When planning for retirement, it’s essential to compare different income strategies to find the best fit for your needs. For South Carolinians, annuities offer guaranteed income, tax-deferred growth, and protection against longevity risk, which can complement other retirement income sources like Social Security, pensions, and investment portfolios.

Comparing Annuities With Other Strategies

- Annuities vs. Social Security:

- Guaranteed Income: Both offer guaranteed income, but annuities can provide additional income tailored to your specific needs and risk tolerance.

- Annuities vs. Pensions:

- Flexibility: While pensions offer a fixed income, annuities can be customized with options like joint life payouts or inflation adjustments, making them more flexible.

- Annuities vs. Investment Portfolios:

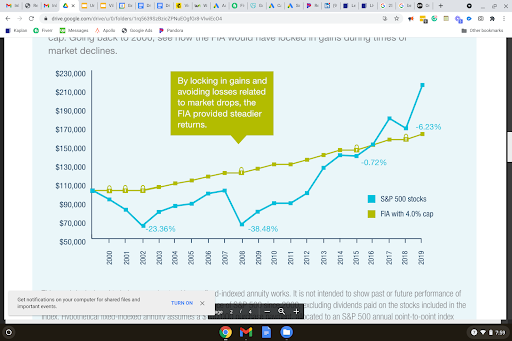

- Risk Management: Annuities provide a safer, predictable income stream, unlike investment portfolios, which are subject to market volatility.

Considerations for South Carolinians

- State-Specific Benefits:

- Tax Efficiency: South Carolina does not tax Social Security benefits and provides substantial deductions for other types of retirement income, including pensions and annuities, for residents 65 and older. Annuities with tax-deferred growth can help maximize these tax benefits.

- Cost of Living:

- Income Sufficiency: South Carolina has a moderate cost of living, with lower costs in many rural areas and smaller cities compared to national averages. Annuities can provide a stable income source to cover essential expenses, while investment portfolios can be allocated for discretionary spending and future growth.

- Longevity Risk:

- Lifetime Security: Annuities are particularly valuable for protecting against longevity risk, ensuring you won’t outlive your savings, a feature that is not guaranteed by other income strategies.

Case Study: Balancing Retirement Income Sources in South Carolina

A 65-year-old retiree in Charleston combines Social Security, a small pension, and a deferred annuity to create a diversified retirement income strategy. The annuity provides a reliable income stream that supplements their Social Security, while the pension covers basic living expenses. Their investment portfolio is focused on growth, offering flexibility to manage discretionary spending, healthcare costs, and potential future travel or relocation expenses.

Conclusion

For South Carolinians, comparing annuities with other retirement income strategies highlights the unique benefits that annuities offer, such as guaranteed income, tax-deferred growth, and protection against longevity risk. Integrating annuities into your retirement plan can provide stability and security, complementing other income sources. Consulting with a financial advisor can help you develop a balanced strategy that aligns with your financial goals and ensures a comfortable retirement.

Curious about building a stable retirement income? Contact us today for a personalized consultation and learn how to secure your future with a guaranteed income, free from market risk!